The post Ethereum Faces Strong Rejection Above $1.9K! Here’s The Next Level For ETH Price appeared first on Coinpedia Fintech News

Despite several macro challenges, Ethereum (ETH) has been displaying continuous upward momentum and a potential of reaching the $2K mark. However, recent market trends have seen Ethereum face a strong rejection above the $1.9K mark, causing ripples among long-term holders and traders. The rejection at $1.9K was not entirely unexpected. The crypto market has been in a state of flux, with Bitcoin, the market leader, also experiencing similar price resistance.

Whales’ Profit Taking Sentiment Causes Selling Pressure

One significant element contributing to the selling pressure on Ethereum is the profit-taking sentiment among Ethereum whales.

A prominent Ethereum holder transferred a substantial sum of 23,080 ETH, equivalent to roughly $44 million following the cryptocurrency’s price escalation above $1,904. This move indicates that significant stakeholders are beginning to capitalize on their gains in light of Ethereum’s recent price surge.

The average price at which the whale withdrew Ethereum hovers around $1,820. This figure is considerably lower than the most recent peak price, implying a cautious strategy towards risk management and a tendency to secure profits during times of price appreciation.

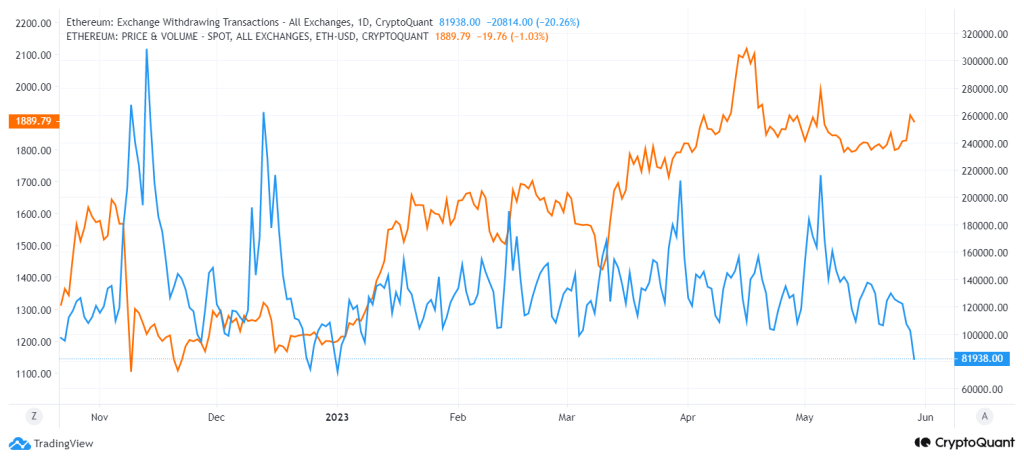

Moreover, analyzing on-chain data, Ethereum’s withdrawing transaction metric has been declining following ETH’s recent big red candle. The metric is currently at 81K level which was last seen in January.

Withdrawal transactions are the transfer of Ethereum from exchanges to personal wallets. High withdrawals suggest investors are holding ETH privately, possibly anticipating a price rise. Low withdrawals imply more ETH is stored on exchanges, often indicating upcoming sales.

A decline in Ethereum withdrawal transactions can therefore exert downward pressure on the ETH price. This is because when large amounts of ETH are kept on exchanges, it increases the supply of Ethereum available for trading. If the demand does not match this increased supply, it can lead to a surplus of ETH on the market, which can subsequently cause the price to drop.

What’s Next For ETH Price?

Ether has been in a declining wedge pattern for several days. On May 25, despite bears’ efforts to lower the price to the wedge’s support line, bulls bought the dip aggressively, evident from the long candlestick tail. As of writing, ETH price trades at $1,892, gaining over 2% in the last 24 hours.

However, ETH price today witnessed a massive selling pressure, plunging its price from a high of $1,927. Bulls are now attempting to maintain the price above the 20-day EMA at $1,842. If successful, the ETH price could climb to the resistance line at $1,930. This is a crucial level to monitor as a break above it could trigger a rally to $2,000.

However, if the price drops from the current level or drops below the 38.6% Fib channel, it will indicate that bears are still dominant at higher levels. This could result in the ETH price remaining within a bearish region for a few more days.