The post Ethereum’s Whale Volume Skyrockets Over 500% Amid Market Slump: Signs of a Rebound? appeared first on Coinpedia Fintech News

Economic tensions are still putting pressure on the crypto market. Tariffs introduced by the Trump administration have led declines in many altcoins, including Ethereum, which is currently struggling and trading in a bearish zone. Analysts predict Ethereum’s price may stay within a narrow range if these economic conditions continue. However, there is potential for a recovery soon, as large investors appear to be buying more, despite Ethereum’s recent drop below $1,500.

Ethereum’s Whale Pressure Skyrockets Over 500%

Ethereum’s price has dropped below $1,500 due to increased bearish pressure, triggered by Trump’s announcement about tariffs. This situation has caused a significant sell-off, with nearly $78.8 million worth of Ethereum being liquidated, according to data from Coinglass. Out of this, $48.1 million was from buyers and $30.6 million from sellers closing their positions. Despite these bearish conditions, Ethereum holders are remaining loyal and are not rushing to sell their holdings.

The investor who recently reactivated their wallet is still sitting on an unrealized profit of around $12.3 million, despite it having reached over $45 million at Ethereum’s peak in 2021. No sales were made then, and currently, despite a bearish market, whales are not showing a willingness to sell.

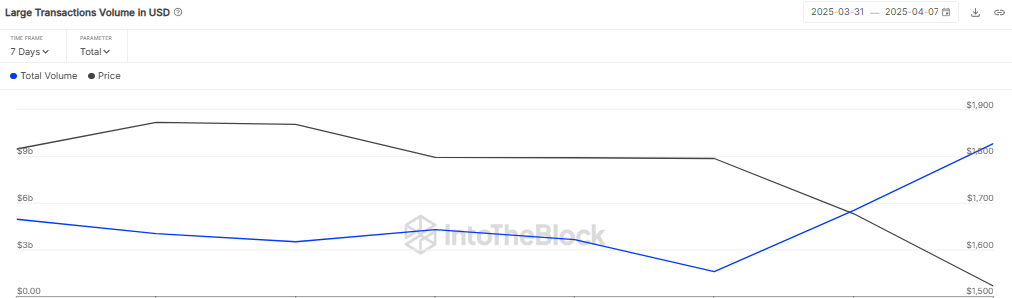

According to data from IntoTheBlock, the volume of large transactions has soared by nearly 520% as whales buy more Ethereum while its price is below $1,500. The amount of these transactions jumped from $1.58 billion to over $9.8 billion. This indicates that whales are heavily purchasing Ethereum during this price dip, which could mean they are accumulating more and potentially setting the stage for a price rebound.

Also read: Ethereum (ETH) Headed to $1,000? Chart Flashes Sell-Off Signal

However, Ethereum’s MVRV ratio has dropped significantly in recent times. IntoTheBlock shows that the Ethereum MVRV currently stands at 0.76, lowest since December 2022. A level below 1 suggests that market value is less than the last realized value of Ethereum. It hints at significant unrealized losses across the Ethereum network. This level was last observed during the market crash of late 2022.

What’s Next for ETH Price?

Ethereum’s price has been declining sharply, breaking below immediate support channels and is now aiming for a drop toward Fibonacci channel. Though buyers are attempting a rebound, sellers continue to hold the price within a bearish region. As of writing, ETH price trades at $1,458, declining over 6.6% in the last 24 hours.

The ETH/USDT trading pair is hovering just below EMA20 trend line, which could present a significant hurdle. If it can maintain above this level, it could be beneficial for buyers, potentially driving the price toward descending resistance line. A surge above that level could send the ETH price toward $2K.

Conversely, if the price holds below the EMA20 trend line on the 1-hour chart, sellers could drive it down to around $1,300. Further bearish pressure might keep Ethereum around the $1K level.