The post No ‘Santa Rally’ for Crypto: Why Is Ethereum Down Today? appeared first on Coinpedia Fintech News

The cryptocurrency market has been stuck in a downward trend, and many investors are still waiting for the much-anticipated “Santa Rally” to kick in. But as the overall market cap drops to $3.32 trillion, it’s clear that recovery isn’t coming anytime soon.

Ethereum, once again, finds itself in a tough spot, losing about 4% and trading at $3,354.5. Despite a market sentiment leaning toward greed, the numbers tell a different story. So, why is Ethereum struggling today?

ETH Price Performance

Looking at Ethereum’s four-hour charts, it’s clear the price faced strong resistance at the $3,524 level. Both the 50-period and 20-period moving averages failed to support the price. On December 23, a “death cross” formed on this timeframe, signaling a potential price drop, which appears to be happening now.

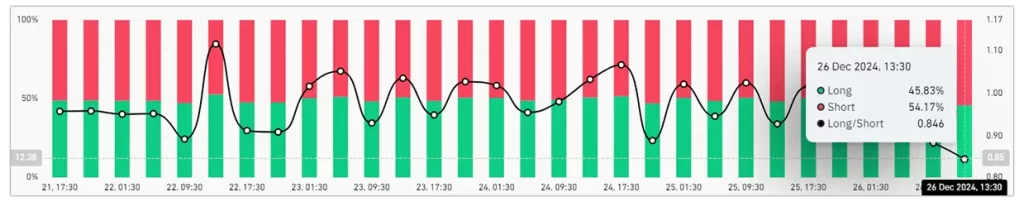

Ethereum’s trading activity has dropped by 10.06%, suggesting that traders are stepping back from the asset. Despite a surge in open interest of about $1 billion, the long-to-short ratio is 0.846, with 54.17% of open future trades for ETH being shorts. This indicates that traders are generally bearish on Ethereum’s short-term prospects.

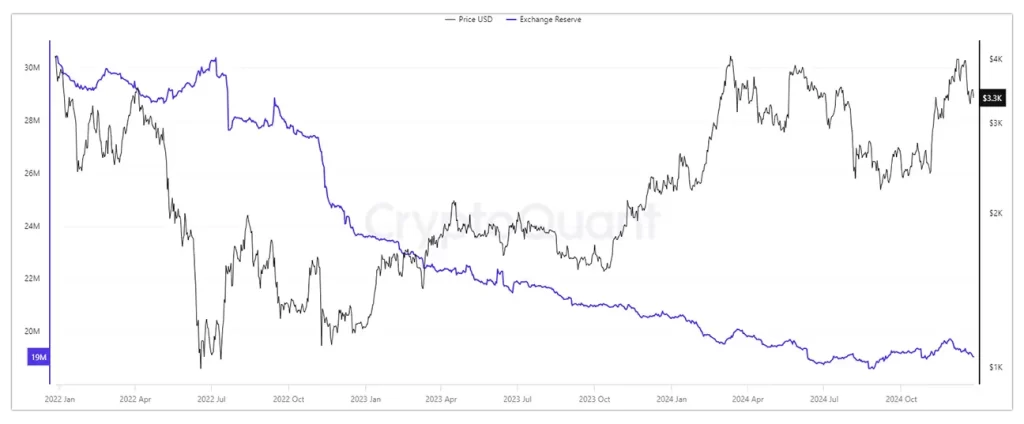

Exchange Reserves Dip: Good Sign?

On the positive side, CryptoQuant data shows Ethereum’s exchange reserves are decreasing, meaning investors are moving their assets to cold wallets. This shift indicates growing confidence in Ethereum’s long-term potential and may signal an upcoming price rise. As of now, exchanges hold only 19.05 million ETH tokens, reflecting this increased confidence.

Farside data reveals that Ethereum ETFs saw a modest inflow of $53.6 million on December 24, with no significant outflows. BlackRock’s ETHA ETF saw the largest inflow at $43.90 million, followed by Bitwise’s ETHW at $6.19 million, and Fidelity’s FETH at $3.45 million.

What’s Next for Ethereum?

Despite the current market’s bearish sentiment, the drop in exchange reserves points to rising investor confidence in Ethereum’s future. While the price is down right now, the momentum is building slowly. Many are asking, “Why is Ethereum down today?” but the real question might be whether they’re missing the bigger picture.

As we discussed in our Bitcoin analysis, the market often surprises traders. When sentiment is overly bearish, crypto tends to move in the opposite direction, creating opportunities for those who understand market trends. Smart investors know how to predict the next move.

The story is far from over. Patience and strategic moves will separate the winners from the rest!