The post Pepe Price Loses Crucial Support As Whale Transaction Declines To $48 Million: Is Pepe Heading Toward A Crash? appeared first on Coinpedia Fintech News

This week, the price of Pepe has not shown significant swings, consistently falling below key support levels. While the Bitcoin price has difficulty attracting buyers, the meme coin market is experiencing an increase in liquidations. Furthermore, interest from large-scale investors in the Pepe meme coin has decreased recently, potentially leading to a sharp drop in its price soon.

Pepe’s Whale Transaction Drops To $48 Million

Over the last 24 hours, Pepe price witnessed significant liquidations as bulls closed their positions heavily following a bearish turnaround in the Pepe price chart. Data from Coinglass shows that Pepe price witnessed total liquidation of nearly $1.51 million, out of which buyers liquidated around $1.3 million worth of positions.

The cryptocurrency market rebounded midweek after a challenging start. Bitcoin (BTC) prices rose above $58,000, and Ethereum (ETH) prices surpassed the $3,100 mark on Wednesday. However, Pepe continued to face a bearish decline as it lost support from traders, resulting in a declined volatility.

The market recovery is linked to rising inflow of Bitcoin ETFs and the excitement building around the upcoming Ethereum ETFs approval.

As the second-largest meme coin project on Ethereum, PEPE’s price is poised to gain from positive momentum as Ethereum ETFs start attracting investments with the anticipated SEC approval for trading. Recent market developments suggest that investors in PEPE are preparing for this major event.

On-chain data indicates that whale investors are using the stable prices to decrease their holdings of PEPE tokens, likely in anticipation of further losses.

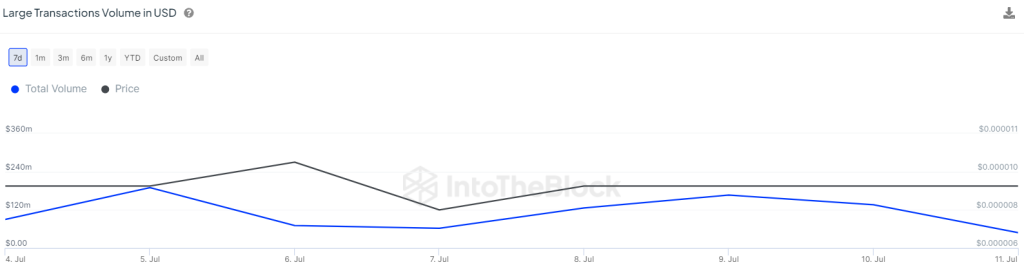

The IntoTheBlock chart shows that daily PEPE transactions over $100,000 provide insights into investor activity. The volume of PEPE whale transactions dropped in the last few days to $48.7 million. The metric dropped from the peak of $190 million on July 5.

With less buying pressure from these large investors, Pepe’s price may drop. Additionally, the reduced presence of whales could lower market confidence.

What’s Next For Pepe Price?

Pepe is experiencing a consolidation phase within a downtrend, with its price oscillating between $0.00001 and the psychological support level of $0.0000078. However, bulls continue to defend a decline. As of writing, Pepe price trades at $0.00000868, declining over 2.1% in the last 24 hours.

The declining moving averages and a Relative Strength Index (RSI) in negative territory suggest that the bears have the upper hand. A sudden drop below $0.00000768 could further empower the bears, potentially driving the PEPE/USDT pair down to $0.0000041.

On the flip side, the $0.00001 mark stands as a critical resistance level. Overcoming this barrier could signal the beginning of a robust recovery. Although the 50-day Simple Moving Average (SMA) at $0.0000136 may pose some resistance, it is expected to be breached if upward momentum continues.