The post Ripple News: XRP Price Prediction and Speculation Amid Regulatory Wins appeared first on Coinpedia Fintech News

After a series of legal wins and being the only regulated crypto in the space, XRP price prediction for the weekend is attracting many interested investors. Ripple’s native token, XRP, is trading at $0.60 and has remained green for three consecutive days.

The fifth most significant currency in market cap worth $32 billion spiked nearly 17% in the last two weeks, despite price predictions stating otherwise. This positive outlook is supported by key market indicators such as the 20-day Exponential Moving Average (EMA) and a robust Relative Strength Index (RSI), both suggesting that bullish sentiment is prevailing.

However, it’s important to note that the cryptocurrency market can be quite volatile. If a bearish momentum takes over, the value of XRP could decline and fall below $0.55. In such a scenario, there’s a possibility of a downward trajectory that could lead XRP toward the 50-day Simple Moving Average (SMA) at $0.50. Therefore, traders closely monitor these price levels for significant market cues that might determine XRP’s direction.

How About $100 Trillion XRP Flow?

Meanwhile, there has been speculation within the XRP community regarding what could happen if an astronomical sum of $100 trillion were to flow through XRP. Some enthusiasts suggested that if XRP were to capture 10% of the derivatives market, equivalent to $100 trillion, its price could potentially skyrocket to $1,896. This speculation emerged after Ripple joined the International Swaps and Derivatives Association (ISDA) in August, which led to discussions about XRP’s potential in the derivatives space.

Analyst Simplifies: What Ralies Between Trading Volumes

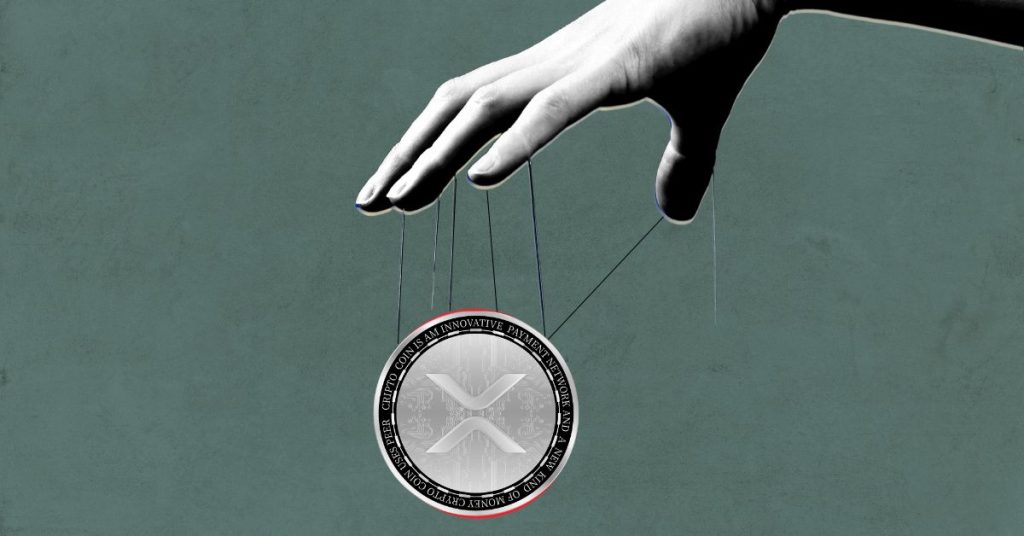

However, prominent XRP community member Mason Versluis has recently attempted to clarify this matter. He pointed out a critical distinction between money flowing into an asset (which impacts its market cap) and money flowing through an asset (which relies on its trading volume). Essentially, he stressed that increasing the market cap doesn’t necessarily reflect how much money is actively flowing through the coin. Instead, it’s the volume that matters more in this context.

On the flip side, XRP stands out among cryptocurrencies due to its substantial 24-hour trading volume. It ranks as the third-largest cryptocurrency in trading volume, trailing behind only Bitcoin (BTC) and Ethereum (ETH), excluding stablecoins. Looking at the recent decline of 29.36% in the overall trading volume, it still maintains a trading volume of around $1.27 billion, indicating considerable liquidity and a 10% surge in trading activity.

A Never Before Possibility.

While capturing $100 trillion in fund flows through XRP could have substantial implications for its price and market cap, these effects are not as straightforward as initially projected. Changes in trading volume tend to be more immediate indicators of a cryptocurrency’s activity and relevance in the market.